Download our Flowchart: Will I Have To Pay Tax On My Qualified ESPP?

Employee Stock Purchase Plans can be an important benefit for clients. These programs can allow the purchase of employer stock at a discount, which creates an incentive for employees to increase their ownership stake with their employer.

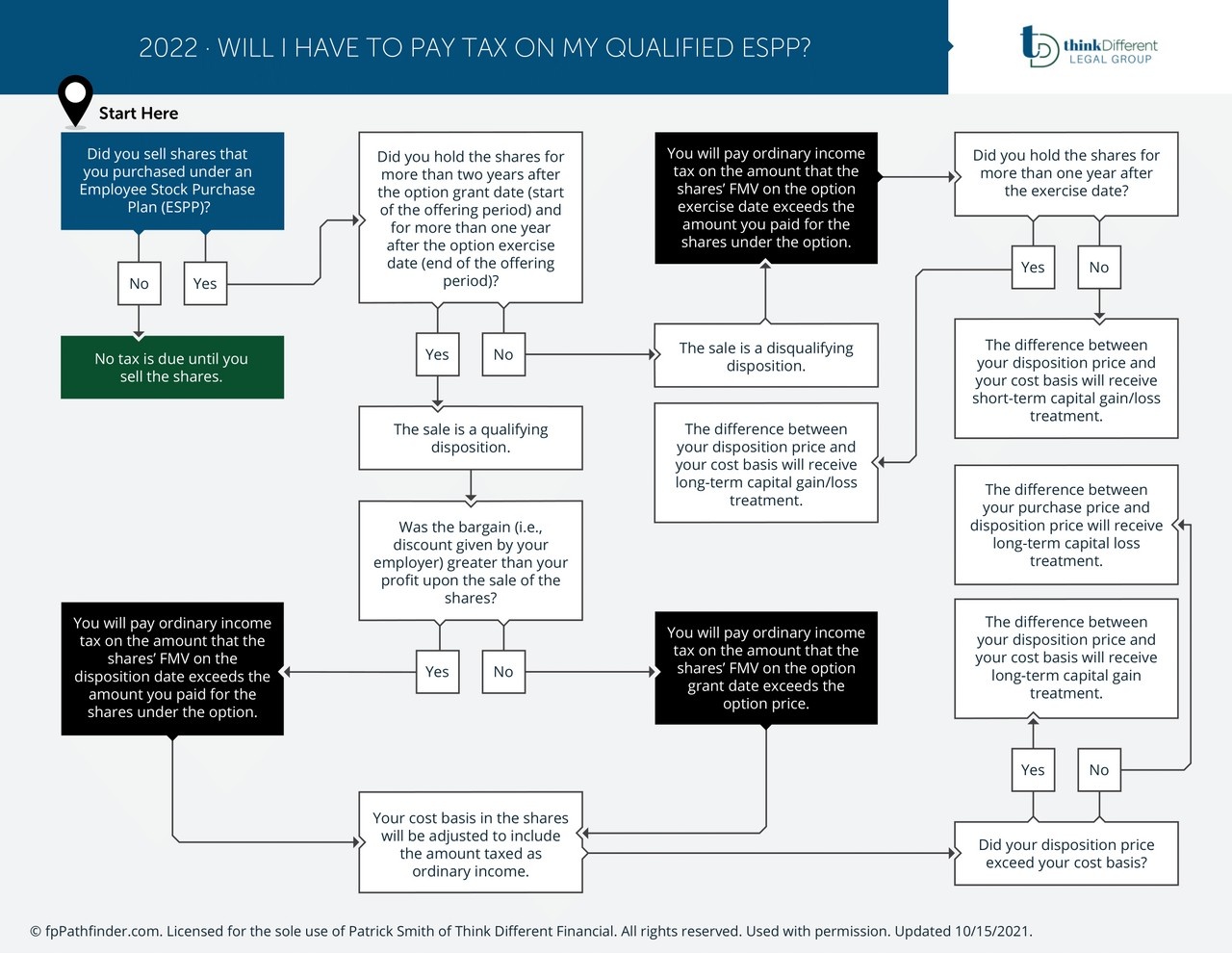

The tax impact upon the sale of shares within an ESPP varies based on how long the shares were held and at what price they were sold. The tax treatment depends on whether a sale is a qualifying disposition or a disqualifying disposition.

This flowchart addresses the tax consequences clients will face when participating in their ESPP, and maps the tax calculations upon the sale of employer stock acquired through their plan.

We won't send spam. Unsubscribe at any time.