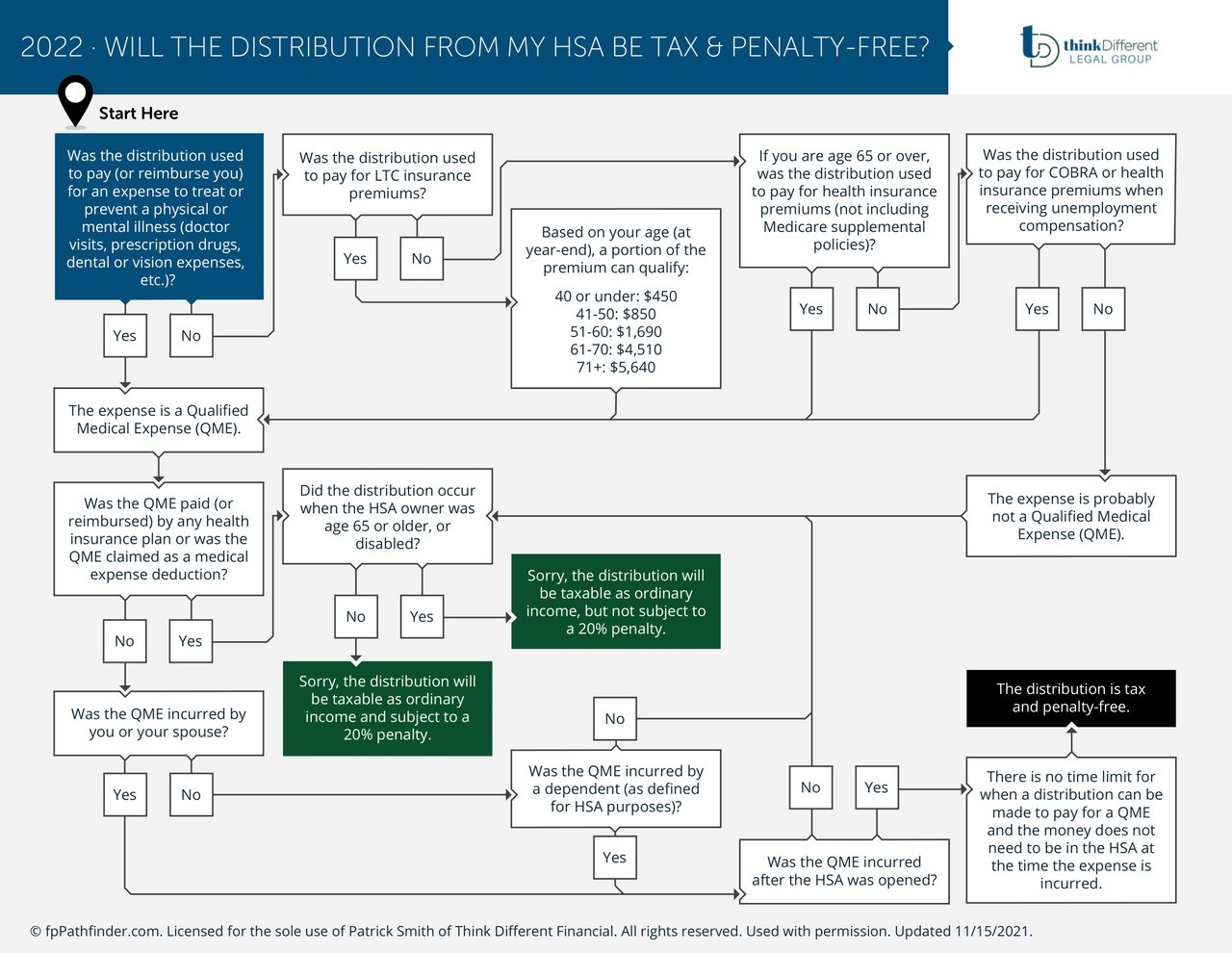

Download our Flowchart: Will The Distribution From My HSA Be Tax & Penalty-Free?

An HSA account is one of the most tax-efficient savings accounts available to investors. While many of the distribution rules are straightforward, there are several factors and exceptions that should be considered before a client takes a distribution from their HSA, including:

Classification as a Qualified | Medical Expense | Eligibility of LTC insurance premium payments | Eligibility of health insurance premium payments | Impact if the distribution occurs before/after turning age 65 | Use of HSA funds to pay | Qualified Medical Expenses of family members | Timing of expenses

We won't send spam. Unsubscribe at any time.