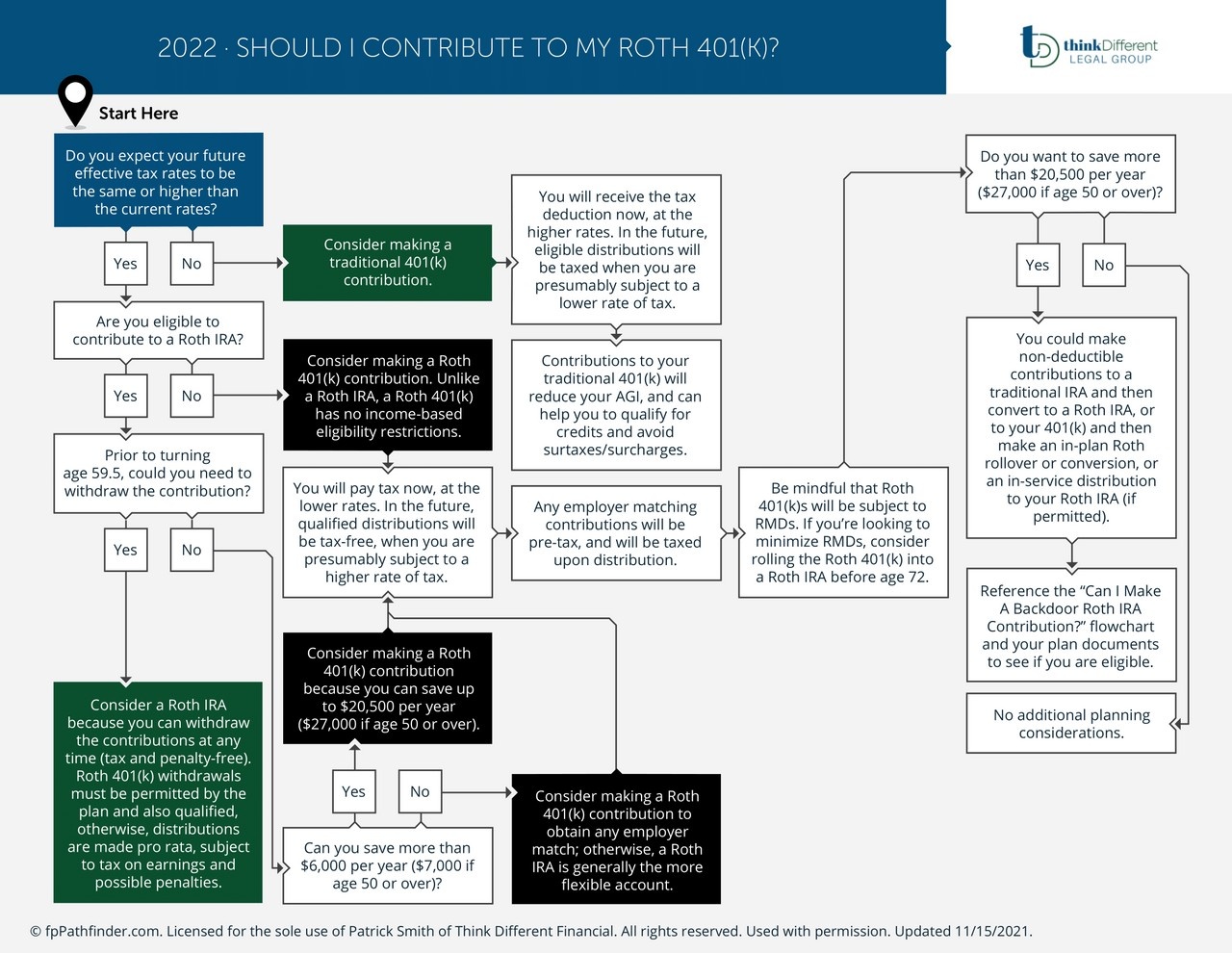

Download our Flowchart: Should I Contribute To My Roth 401(k)?

Roth 401(k)s have become an increasingly popular alternative to traditional 401(k)s, allowing participants to make after-tax salary deferrals to their employer plans. Many clients may have the opportunity to contribute to a designated Roth account in their 401(k), but are uncertain about the best savings strategy for their personal circumstances. This flowchart helps guide you through a series of considerations that will inform their decision whether to contribute to a Roth 401(k), and covers:

Future tax rate expectations | Roth IRA eligibility | Employer matching considerations | RMDs and future rollover options | Additional savings opportunities through backdoor Roth contributions

We won't send spam. Unsubscribe at any time.